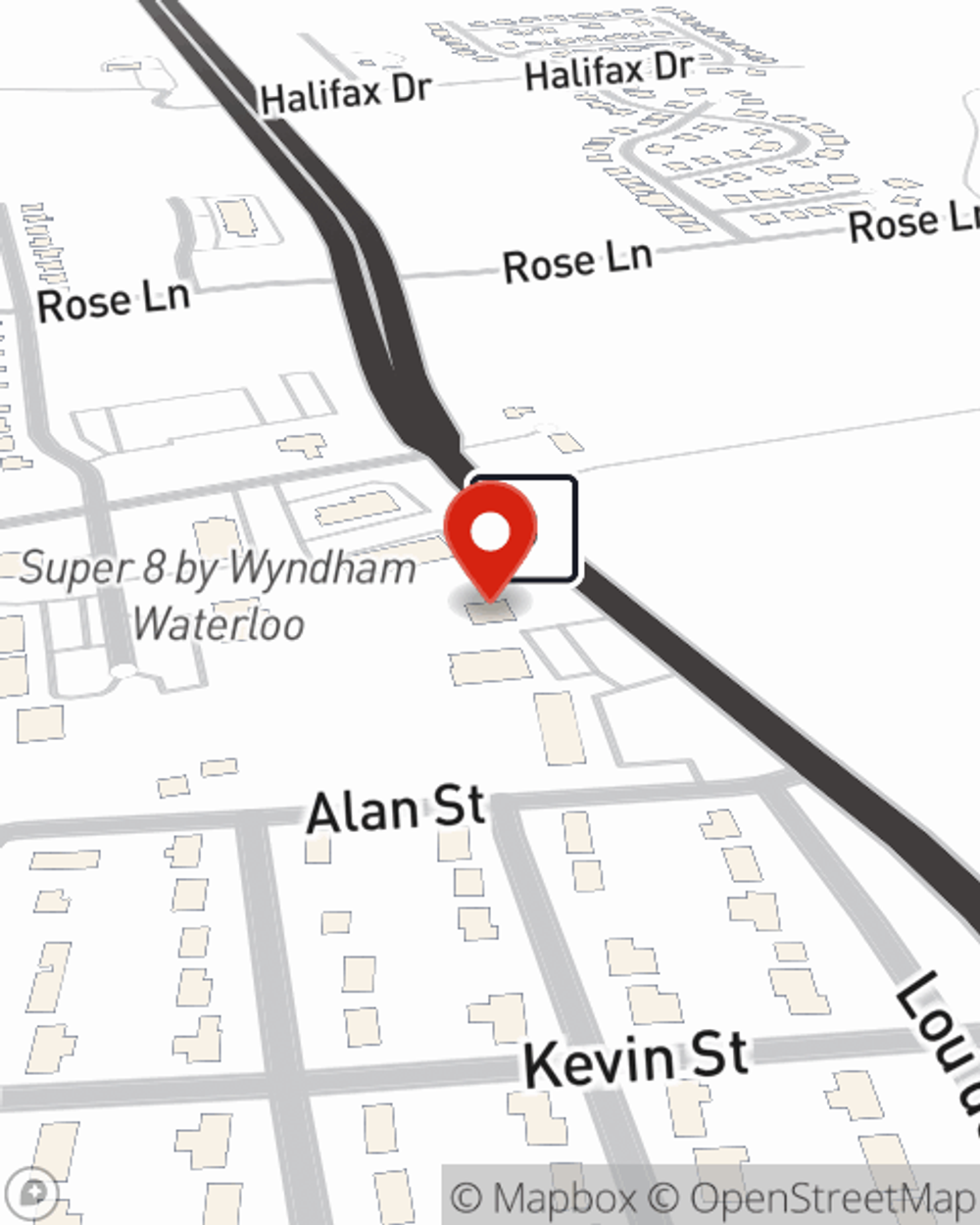

Business Insurance in and around Waterloo

One of Waterloo’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

- Waterloo, IL

- Valmeyer, IL

- Columbia, IL

- Monroe County

- Randolph County

- St Clair County

- Clinton County

- Millstadt, IL

- Belleville, IL

- St Louis County

- St Louis Metro Area

- Red Bud, IL

- Freeburg, IL

- Smithton, IL

- Madison County

- Jefferson County

- St Charles County

- Serving IL and MO

- New Athens, IL

Help Prepare Your Business For The Unexpected.

Owning a business is about more than being your own boss. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for everyone you care for. Because you do whatever it takes to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with business continuity plans, extra liability coverage and a surety or fidelity bond.

One of Waterloo’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Get Down To Business With State Farm

At State Farm, apply for the excellent coverage you may need for your business, whether it's an antique store, a barber shop or an ice cream shop. Agent Stacy Jackson is also a business owner and understands what you need. Not only that, but exceptional service is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

Agent Stacy Jackson is here to consider your business insurance options with you. Contact Stacy Jackson today!

Simple Insights®

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Stacy Jackson

State Farm® Insurance AgentSimple Insights®

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.