Life Insurance in and around Waterloo

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

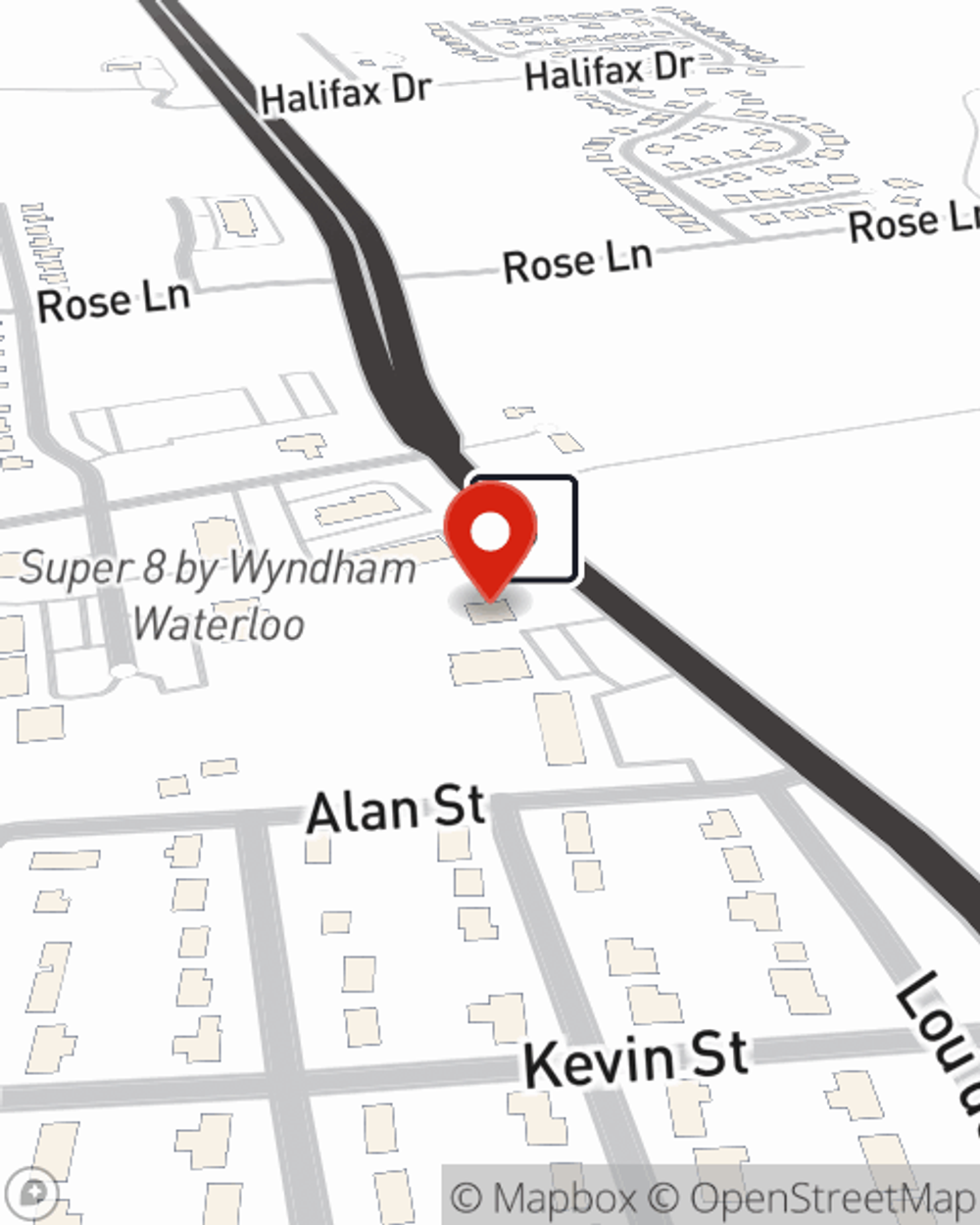

- Waterloo, IL

- Valmeyer, IL

- Columbia, IL

- Monroe County

- Randolph County

- St Clair County

- Clinton County

- Millstadt, IL

- Belleville, IL

- St Louis County

- St Louis Metro Area

- Red Bud, IL

- Freeburg, IL

- Smithton, IL

- Madison County

- Jefferson County

- St Charles County

- Serving IL and MO

- New Athens, IL

Protect Those You Love Most

Buying life insurance coverage can be a lot to ponder with several different options out there, but with State Farm, you can be sure to receive considerate caring service. State Farm understands that your primary reason is to help provide for your loved ones.

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

State Farm Can Help You Rest Easy

Service like this is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Stacy Jackson is here to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

Looking for a life insurance option that even those who thought they couldn't qualify could benefit from? Check out State Farm's Guaranteed Issue Final Expense. It can prove useful to cover final expenses, such as medical bills or funeral costs, without burdening your loved ones. Contact your local State Farm agent Stacy Jackson for help with all your life insurance needs.

Have More Questions About Life Insurance?

Call Stacy at (618) 939-7900 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Stacy Jackson

State Farm® Insurance AgentSimple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.